VAT Domestic Reverse Charge

Suppliers of labour in the construction industry

New rules are set to be introduced from March 1st to prevent suppliers charging VAT and not paying it to HMRC. These rules were previously due to be introduced in 1st October 2019, and then again in October 2020 but both these start dates were postponed.

“Reverse charge” relates to supplies in the construction industry to building contractors. This includes goods when supplied with services – even if separate invoices.

Supplies in the Construction Industry

EXAMPLE Dean – a self-employed plumber – supplies services to building contractors

Current invoice to ABC Ltd:

Services supplied 10,000

VAT 2,000

Gross invoice 12,000

ABC Ltd pays £12,000 Reclaims £2,000 VAT from HMRC

From 1 March 2021 invoice to ABC Ltd:

Services supplied 10,000

VAT 0

Gross invoice 10,000

ABC Ltd pays £10,000 Reclaims £2,000 VAT from HMRC and also pays over £2,000 VAT to HMRC

VAT Return entries for Dean Box 6 (net sales) £10,000

ABC Ltd Box 1 and Box 4 (VAT) £2,000 Box 7 (net purchases) £10,000

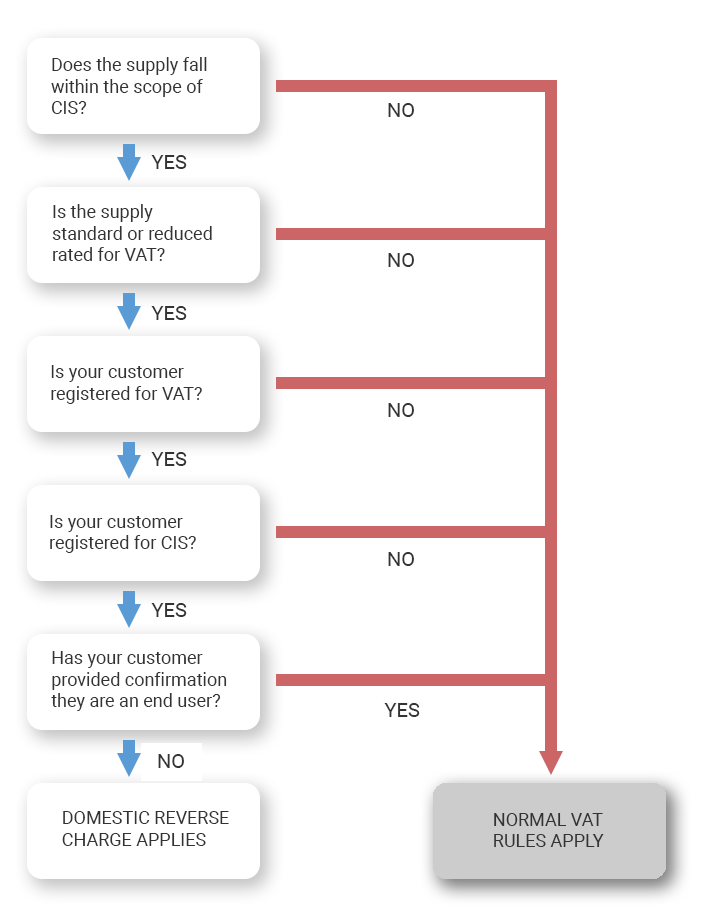

Use this flowchart to see how you would decide whether to apply normal VAT rules, or apply the domestic reverse charge.

Do not use it for services supplied by employment businesses.

End User

End users are those who receive building and construction services but do not sell on those services as construction services

For example

- Electrician rewiring a commercial property and invoices the owner direct

- Bricklayer carrying out work at head office of his builder customer

The supplier’s position

HMRC’s suggestion for suppliers of construction services, especially if they often deal with end users – state in contract: “We will assume you are an end user unless you say you are not.”

Therefore continue to charge VAT unless customer says otherwise.

No legal obligation for the supplier to establish the status of the customer.

The customer’s position

End User

- It will be up to the end user to make the supplier aware, in writing, hard copy or electronically, that they are an end user and that VAT should be charged in the normal way instead of being reverse charged. But no legal obligation to do so.

- Must ensure not charged VAT incorrectly if rules apply

- If so, input tax will still be reclaimable – but HMRC may assess the output tax that should have been paid.

- Will need to obtain a refund from the supplier.

Examples of services

- Construction, alteration, repair, extension, demolition or dismantling of buildings, structures or related land

- Installation in any building or structure of systems of heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection

- Erecting scaffolding

- Landscaping

- Roadworks, powerlines, electronic communications apparatus, aircraft runways, docks and harbours, railways, inland waterways, pipe-lines, reservoirs, water-mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- Internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- Painting or decorating the internal or external surfaces of any building or structure

Exclusions Supplies if supplied on their own:

- Drilling for, or extraction of, oil or natural gas

- Manufacture of components for systems of heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection, or delivery of any of these things to site

- Sign writing and erecting, installing and repairing signboards and advertisements

- Extraction of minerals and tunnelling or boring, or construction of underground works, for this purpose

- The professional work of architects or surveyors, or of consultants in building, engineering, interior or exterior decoration or in the laying-out of landscape

- The installation of seating, blinds and shutters

- Manufacture of building or engineering components or equipment, materials, plant or machinery, or delivery of any of these things to site

- The making, installation and repair of artistic works, being sculptures, murals and other works which are wholly artistic in nature

- The installation of security systems, including burglar alarms, closed circuit television and public address systems

Invoicing

- Show all the information normally required to be shown on a VAT invoice

- The invoice must state that the domestic reverse charge applies and that the customer is required to account for the VAT. Put on the invoice “Domestic Reverse Charge: VATA 1994 section 55A applies”

- State the customer’s VAT number on the invoice

- State the amount of VAT due but do not include in the total amount charged

If you need any further information, please don’t hesitate to give us a call.